[eBook] The PFAS Handbook: The Ultimate Guide to Identifying & Mitigating PFAS Risks in Your Supply Chain – Download Now

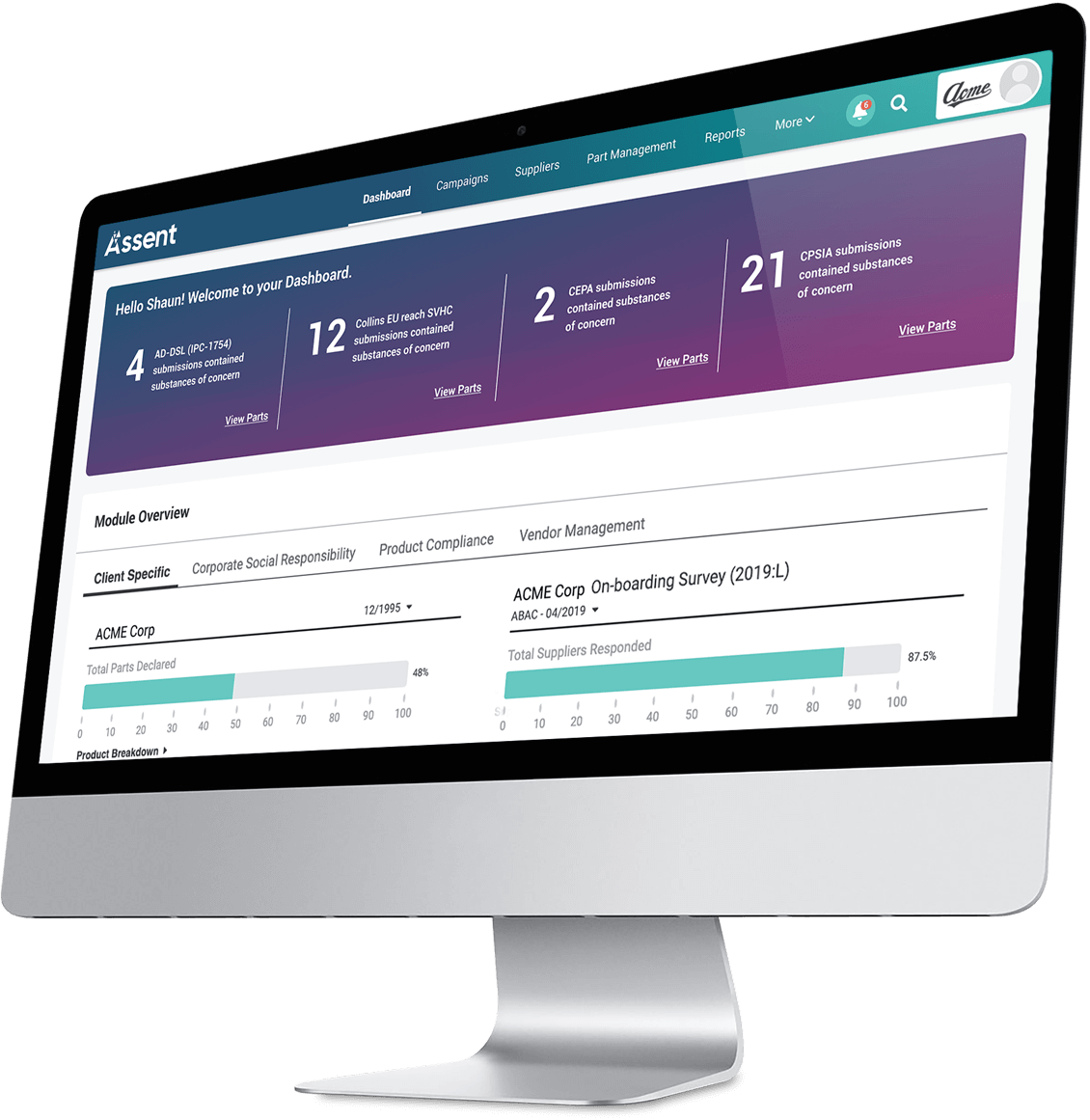

Clear Visibility

Into Supply Chain Risk

Empowering global manufacturers with solutions for

Helping Complex Manufacturers Lead the Way

in Supply Chain Sustainability Management

Join a community committed to setting new standards in compliance and ESG.

Discover Our Featured Solutions & Highlights

304% ROI Over Three Years

According to a commissioned Forrester Consulting Total Economic Impact™ Study, manufacturers that invested in the Assent platform experienced 304% ROI over three years through improved supplier engagement and reduced non-compliance costs.

Download the Study“Assent is probably saving us millions of dollars in fines alone, ignoring any other legal implications of compliance violations.”

— Head of supplier regulatory compliance, home appliances.